Perspective is a gift.

After another turbulent day in the stock market, CNN Money’s recap of that day’s market said it bluntly:

“It was an extremely turbulent day for U.S. stocks, driven by deep fears about China’s economic slowdown. Stocks staged a comeback that nearly brought the Dow back into positive territory but that ultimately failed. Global fears about China’s economic slowdown are shaking stock markets around the world for a second week in a row.”

The article went on to say:

“Stock prices for several iconic American companies declined dramatically in an instant. Shares of General Electric and Pepsi crashed more than 20% apiece at one point, while Costco fell 16%.”

That day, the Dow Jones dropped 1,000 points in the first 10 minutes of trading on news that China’s stock market had dropped 8.5% earlier that day. At the time, the intraday decline was the largest intraday decline the DJIA ever experienced.

Lower oil prices also elevated concerns about a global economic slowdown.

Prior to the opening bell that day, Larry Summers, who served as the Treasury Secretary from 1999-2001 and the Director of the National Economic Council from 2009-2010, tweeted “As in August 1997,1998, 2007 and 2008, we could be in the early stage of a very serious situation.”

By midday, the Dow had recovered all but 102 points of the decline only to falter afterward and close down 588 points. CNN reported the drop “is now sitting in “correction” territory — a 10% decline from a recent peak.”

The above story could very easily have been written about the market’s performance several weeks ago. It wasn’t. The day mentioned above was August 24, 2015. The DJIA closed that day at 15,871. As of the close of business this past Wednesday, the Dow closed at 23,879, a 50% increase from August 24, 2015.

Hindsight gives us the gift of perspective.

Many of the same concerns from August of 2015 remain today. Lower oil prices, a slowing Chinese economy, and a concern that the Federal Reserve will meddle with interest rates are still worrying investors. The markets have also currently entered “correction” territory, as CNN called it three-plus years ago.

The reality is that markets behave the way they did in August of 2015 more frequently than you think. Since 1980, the average intra-year decline of the S&P 500 is 13.9%. Despite this, the S&P 500 returns have been positive 74% of those years.

Reviewing days such as August 24, 2015, can be instructive not because they will predict what will happen in the future — which they won’t — but instead because they provide perspective, so investors do not make unfounded assumptions about the direction the market will move in the near-term.

Sentiment at that time was similar to what it is today – the fear of slowing global growth and a looming recession. Investors were fearful the markets would continue to go down, which interestingly they only did for one more day, and then went up, ending the year up 10% from August 24. The up-trend continued into 2016 and 2017 with the S&P 500 up 12% and 22% respectively. And while 2018 ended with a high degree of volatility, the year itself may not have been as volatile as you think.

If you were to look at similar large drops in the market before August 2015 with the perspective that comes with hindsight, you would find similar pessimistic investor sentiment. If you overreacted to the market conditions at that time, you likely missed out on greater returns.

We expect the recent market volatility to continue in 2019. The lack of volatility in 2016 and 2017 makes the current market volatility seem worse. Trying to gain perspective while experiencing this volatility is difficult to do. Although it may not feel like it, the U.S. economy is still strong. GDP is still positive and expected to remain so in the next few quarters, with some thought that it may start to slow later this year. Unemployment is at alltime lows. Consumer sentiment remains high.

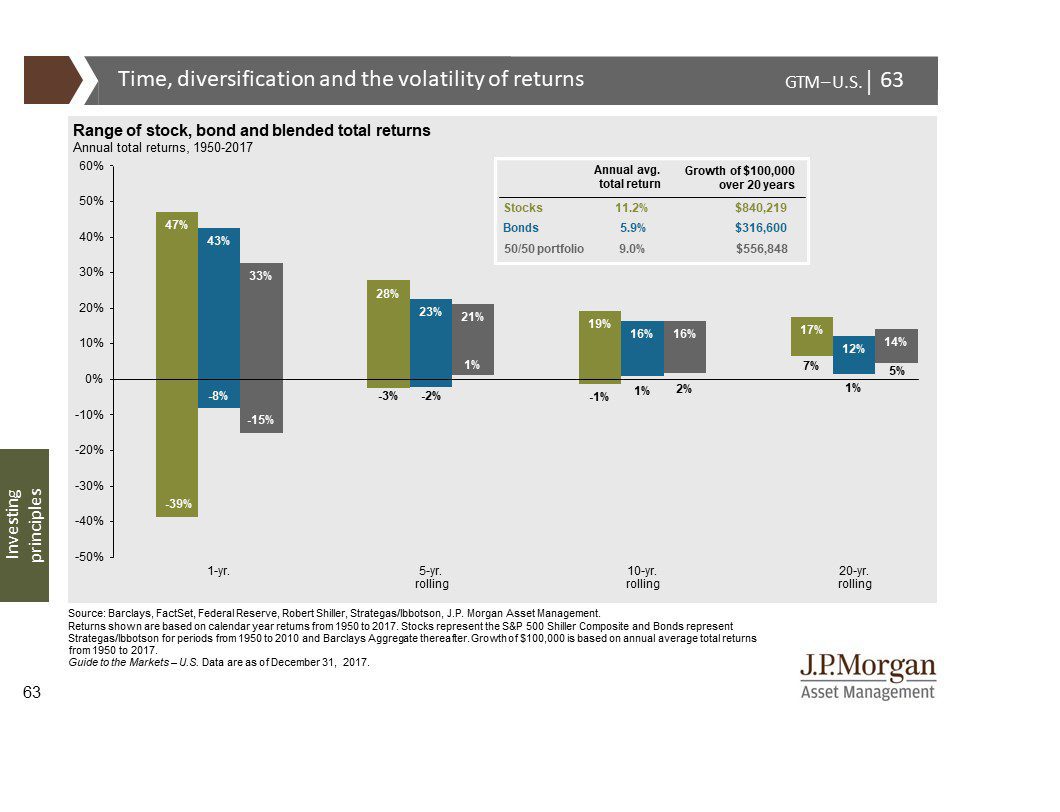

A short-term 1-year view of the market shows increased volatility, as detailed in the graph below. Also illustrated is that the longer the investment time frame, the lower the volatility of returns and the less likely returns are negative.

Perspective is our gift to you.