Plan for tomorrow, today.

That seems like sensible advice, doesn’t it? Yet a surprising number of people leave no estate plan in place for their survivors. It makes a certain amount of sense. Nobody likes talking about death. But this is exactly why you should make an effort to create and maintain an estate plan: you simply won’t be there to settle matters when the time comes.

Everyone has an estate.

Someday, it will be someone’s job to account for the things you leave behind when you die. This goes for homeowners and renters, those who are retired and those who are working full-time, and everyone from every walk of life.

Everyone needs an estate plan.

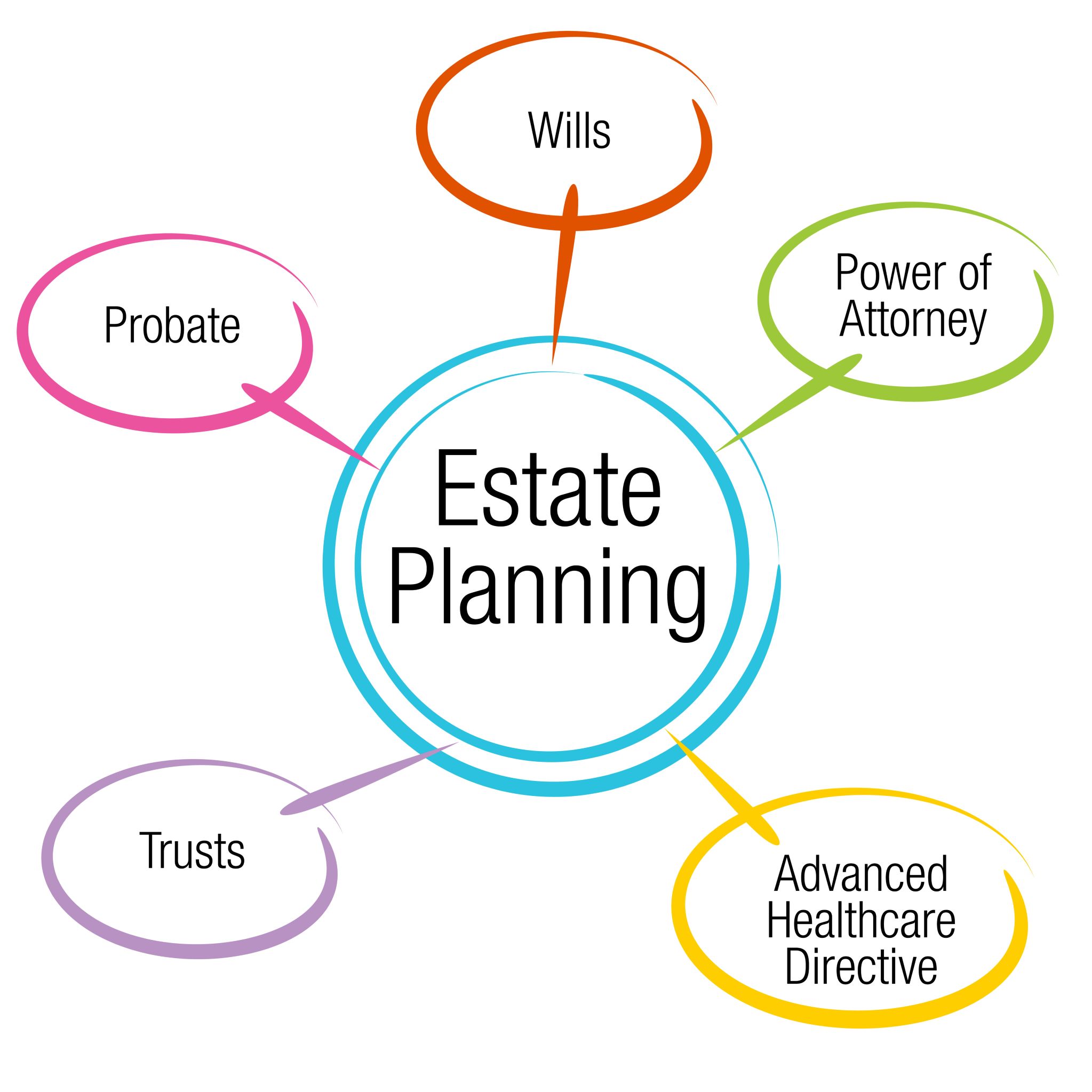

Without your instructions, it could be decided in court. If you don’t leave behind an estate plan, your family could face major legal issues and, potentially, bitter disputes. Your estate plan may include Wills and trusts, life insurance, disability insurance, guidance on the care for children and other dependents, powers of attorney, a living will, medical directives, anatomical donation directives, a pre-or post-nuptial agreement, extended care insurance, charitable gifts, debts, passwords, digital assets, and more.

Why not just a will?

It’s true: everyone needs a Will.

However, while your Will may state who your beneficiaries are, they may still have to seek a court order to have assets transferred from your name to theirs. Estate planning can include items like properly prepared and funded trusts, which could help your heirs to avoid probate. Probate can be an expensive process and lock up assets during the time they’re needed most. Beneficiary designations on qualified retirement plans and life insurance policies usually override bequests made in Wills or trusts. Many people never review the beneficiary designations on their retirement plan accounts and insurance policies, and the estate planning consequences of this inattention can be serious. Having an estate plan means keeping the estate plan updated, as time passes or changes happen in your family.

Where do you begin estate planning?

At EKS Associates, every financial plan we create includes an estate plan. It’s an essential part of your big picture. Speak with us or contact an experienced estate planning attorney to review your estate plan today.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite, LLC, is not affiliated with EKS Associates. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.