When the markets take a sharp dip, it’s natural to feel uneasy. Headlines can be alarming, portfolios can look bruised, and the urge to “do something” often grows louder. At moments like these, it’s easy to forget that market downturns are not unusual—they are part of the natural cycle of investing.

History as a Guide

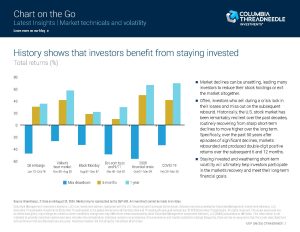

Looking back over the past 50 years, history tells a powerful story: even in the face of oil embargoes, recessions, financial crises, and a global pandemic, the market has demonstrated remarkable resilience. The chart below illustrates just that. After periods of steep decline, the S&P 500 consistently rebounded—often producing strong double-digit returns just 6 to 12 months later.

The Cost of Stepping Aside

Unfortunately, many investors who try to time the market during a downturn lock in losses by selling at the bottom. Worse, they often miss the early stages of recovery—the very period when gains are strongest. Staying invested, even when it feels uncomfortable, is often the best way to capture the long-term growth that markets have historically delivered.

Patience is a Strategy, Not Just a Mindset

We understand that “staying the course” isn’t always easy. It takes discipline and reassurance, especially when the short-term feels uncertain. But patience isn’t passive—it’s an active choice to keep your long-term goals front and center. By weathering short-term volatility, you allow yourself to benefit from the eventual rebound.

This isn’t the first time markets have tested investors’ patience, and it won’t be the last. In fact, we explored this idea in April in our article, Riding Out the Current Market Decline, which shares practical ways to manage uncertainty while staying focused on your goals.

Keeping Perspective, Together

Market downturns can test even the most seasoned investors, but you don’t have to face that uncertainty alone. At EKS Associates, we know that behind every financial plan and every investment account is a family, a retirement dream, and a future legacy. We remain by your side to help you see the bigger picture—reminding you that while market declines are temporary, your goals are long-term. By keeping perspective, together, we can ensure your financial plan stays on track, giving you the confidence to weather today’s volatility and the clarity to stay focused on tomorrow’s opportunities.

If you’re feeling uneasy about today’s markets or your ability to remain financially independent, let’s talk. Together, we will ensure your financial plan continues to work for you—through every cycle.

To view a larger version of the chart, please click here.